Today the EU Global Facility, under the supervision of Alexandre Taymans, opened the first working session on “Transparency and beneficial ownership of legal persons and arrangements: from risk understanding to risk mitigating”.

Organised jointly with the Eastern and Southern Africa Anti-Money Laundering Group (“ESAAMLG”) Secretariat and their BO Project Team composed of representatives from Angola, Botswana, Kenya, Mauritius, Namibia, Tanzania, Zambia and Zimbabwe, the session focused on Financial Action Task Force (FATF) Rec24, Rec25 and Immediate Outcome 5.

The joint session aimed at promoting effective implementation of national beneficial ownership frameworks. It forms part of wider joint work currently conducted by the ESAAMLG to develop a toolkit aimed at assisting their members in assessing the risk related to the misuse of legal persons and arrangements for money laundering and terrorism financing purposes.

“This session has been designed to build the foundation of the future activities that will be conduct in the coming weeks and that will more specifically focus on the ways in which jurisdictions can conduct their risk assessment of LP/LA,” said Alexandre Taymans, EU GF Key Expert on #BO.

This activity will also feed in other activities to increase awareness and understanding of how beneficial ownership opacity contributes to the facilitation of financial crime and other illicit activities.

This first session explored the nuances of the concepts of legal ownership, beneficial ownership and control and unravelled key concepts in FATF’s Recommendations 24 (and its Interpretative Note) and 25.

The group explored the ways in which criminals misuse corporate entities, looking at real-life examples of how shell companies and opaque and complex ownership chains are abused to, amongst others, commit fraud, be involved in corruption, hide wealth and launder proceeds of crime.

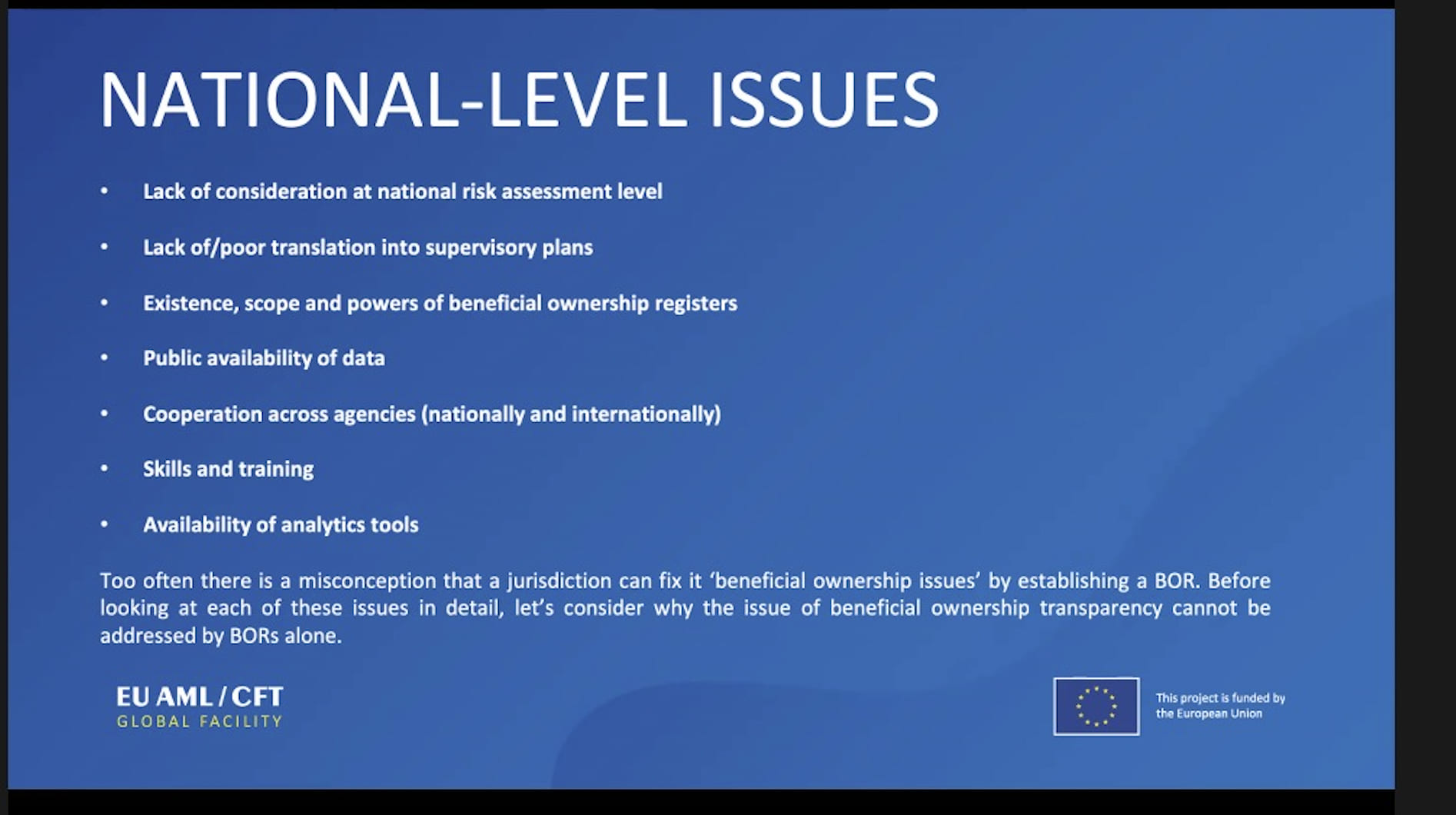

Also discussed were the typical weaknesses in current national BO frameworks, such as limited powers of BO registers, striking the balance between the need for privacy and that for transparency, failures on the part of sectoral supervisors to identify red flags and lack of international cooperation.

The topic of implementation in practice wrapped up the session with a debate around what FATF standards mean in practice and how countries can translate them into effective national framework to prevent and detect the misuse of corporate entities.

In the coming weeks, another session will explore approaches to the assessment of BO-related risks at the national level, translating into practice lessons learnt from this initial session and looking at how to map key issues surrounding the topic in a way that allows jurisdictions to address them.

???????????????????????? Thank you to all participants for their enthusiastic engagement and the interest expressed by the audience!